how to calculate tax on uber income

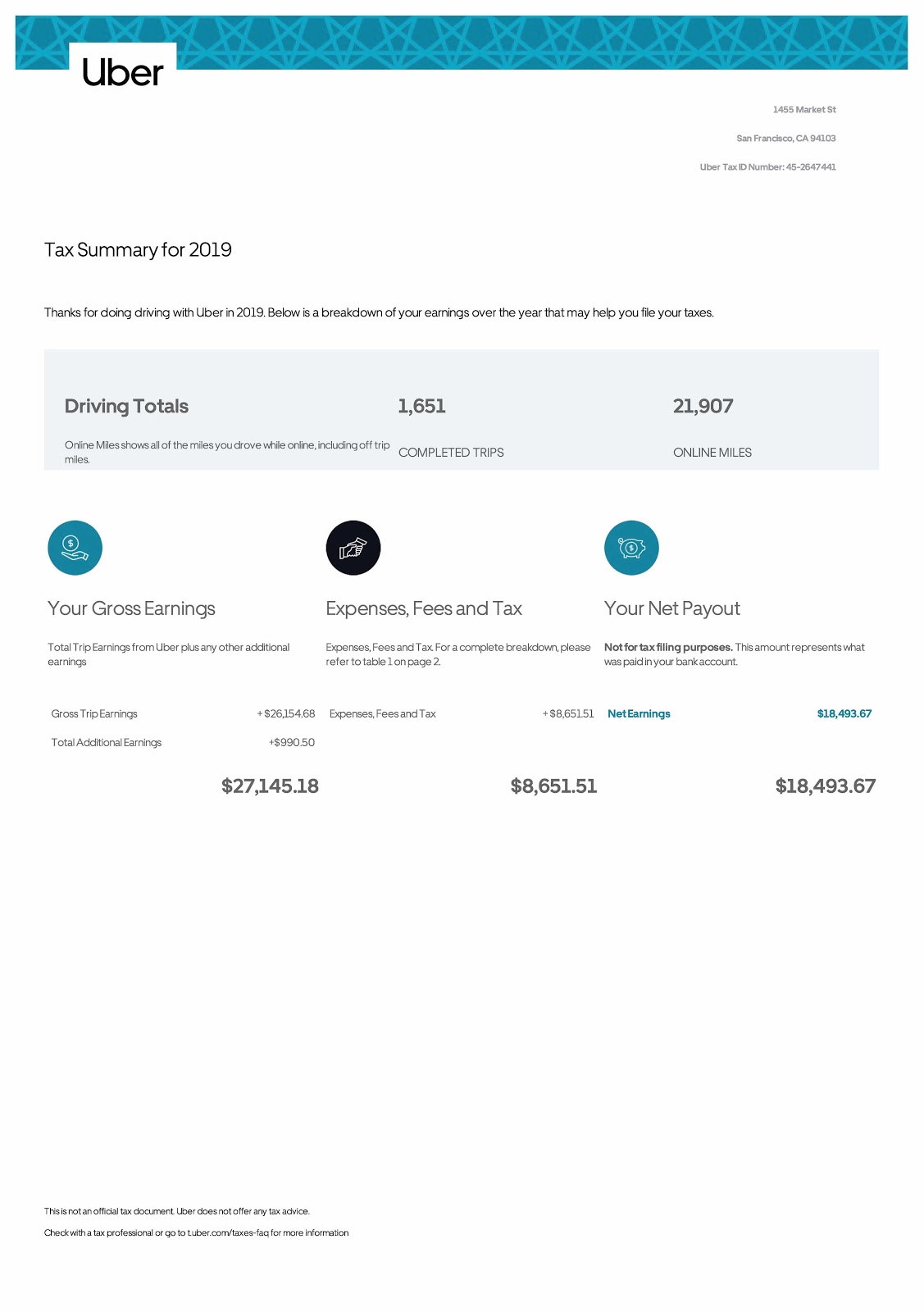

Your Tax Summary document includes. The tax summary available from Uber or Lyft will include some expenses but you may have other deductions that arent tracked by the rideshare companies.

Standard Mileage Vs Actual Expenses Getting The Biggest Tax Deduction Business Tax Deductions Small Business Tax Deductions Tax Deductions

So r t range.

. Can Uber drivers deduct 20 of their income. With our tool you can estimate your Uber or Lyft driver taxes by week month quarter or year by configuring the calculator below based on how much and how often you plan to drive. If your annual income is over 37000 then the tax rate.

For SE self employment tax - if you have a net profit after expenses of 400 or more you will pay 153 SE Tax on 9235 of your net profit in addition to your regular income tax on it. To use this method multiply your total business miles by the IRS Standard Mileage Rate for business. In 2021 this would look like.

Click on Tax Summary Select the relevant statement. Its very tough to write off something like a full car payment or lease though. In fact well leave that up to you.

You can find tax information on your Uber profilewell provide you with a monthly and annual Tax Summary. TurboTax Offers Industry-Specific Tax Solutions So You Uncover Every Business Deduction. Take a look at the current Income Tax rates below.

A l ternating colors. Then we must pay the private income tax for the 75-75 675 it depends on your total income annual. That gets put in the income.

If you have both a permanent job and you drive for Uber alongside this you will need to calculate the tax rate you should be paying at. I printed my Uber Tax Summary and it shows the following. Its very tough to write off something like a full car payment or lease though.

Standard IRS Mileage Deduction. 90 percent of your total tax due for the current year. This is the easiest method and can result in a higher deduction.

I must pay 75 as GST. S ort sheet. So if you have other income like W2 income your extra business income might put you into a higher tax bracket.

100 percent of the tax you paid the previous year or 110 percent if youre a high-income taxpayer. Just add the income from both rideshare companies together and include the total on one schedule. That includes figuring out your car expenses or miles if you.

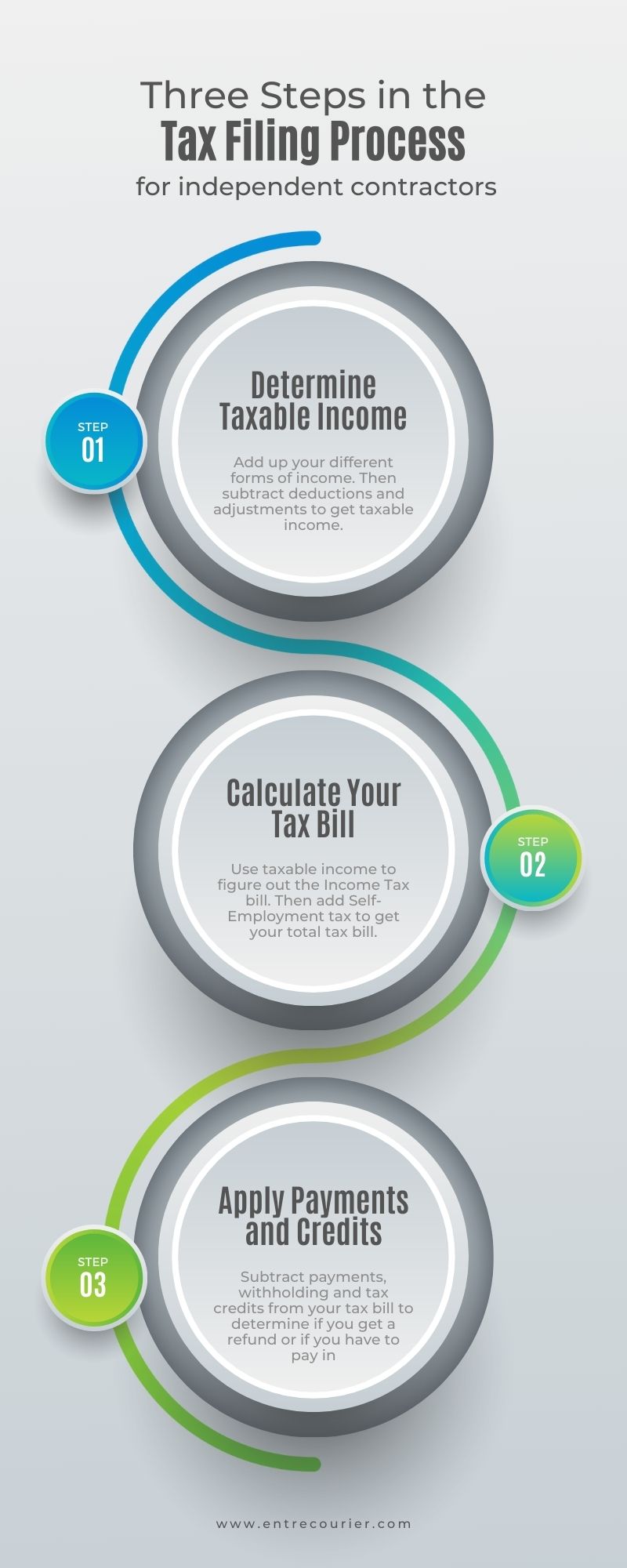

You start out by adding up your income such as from your Uber Eats 1099s or tax summary. C lear formatting Ctrl. Your total earnings gross fares.

Were not going to break down every single expense here. Then you figure out all your business expenses. To get you off to a good start with your business tax deductions Uber provides you with a tax summary that breaks down the totals of both your 1099-K and 1099-NEC.

Earnings per 40-hour week. The tax summary provides a. The whole amount reported on tax summery should not be considered for taxation instead there should be a subtraction between the tips ride fares and cancellation fees.

Filter vie w s. Use business income to figure out your self-employment tax. Can I write off my car if I drive for Uber.

Your annual Tax Summary should be available around mid-July. Income tax starts at 20 on all your income not just from Uber over 12500 and 40 over 50000. The main exception is that you dont have to pay income taxes if your total annual income is less than the standard deduction which is 12550 if youre a single-filer for 2021 taxes what you file in early 2022 and.

Class 2 national insurance is paid as a set weekly amount when your earnings go over 6475 and Class 4 is worked out as 9 on your earnings over 9501. Estimate your business income your taxable profits. Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP.

So a prefect tax professionals assistance is fully required to figure out the exact taxes. With so many people looking to hail a ride the Big Apples Uber drivers have the potential to make up to 3035 an hour. The tax summary shows the total amount your passengers paid for Uber booking fees as well as other fees such as tolls other booking fees and split fare fees.

What the tax impact calculator is going to do is follow these six steps. Ad Follow Our Simple Step-By-Step Process To File Your Rideshare Taxes W Ease Confidence. How to pay quarterly tax as a Uber driver.

10000 work miles x 056 mileage rate 5600 deduction. Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes. Heres how it works if youre manually filling out your tax forms.

Yes you need to pay tax if you drive for Lyft Uber or similar companies like Uber Eats and other ride-share companies. If your annual income is over 18000 and less 37000 then the tax rate is 19 and you can get 675 1-19 54675. You can deduct car expenses like the standard mileage rate or the actual expenses.

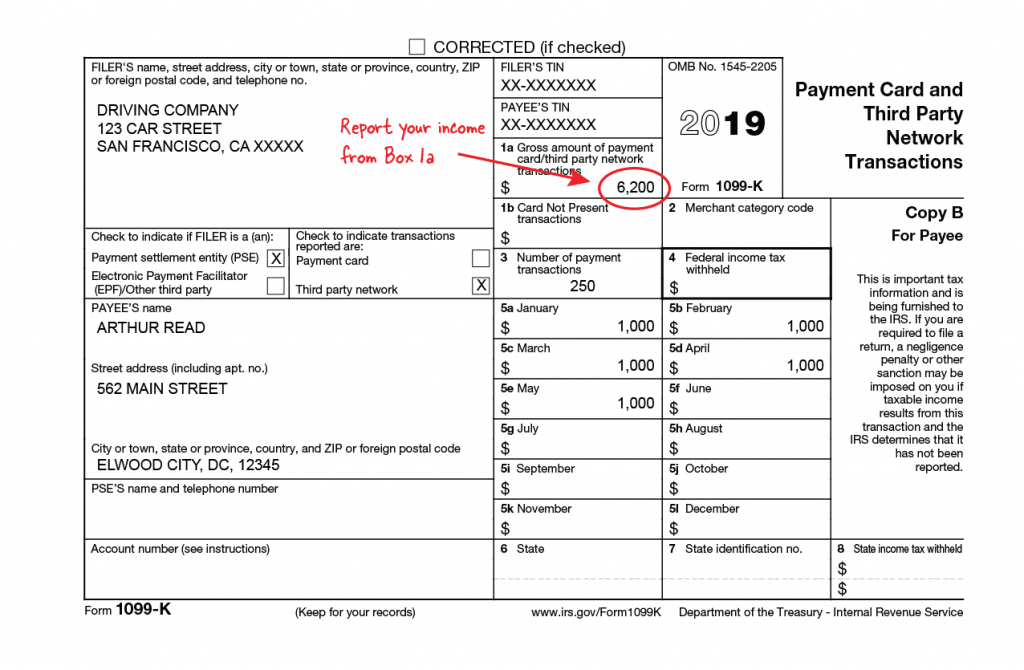

Estimate your business income your taxable profits. The income and tax documents you could get from UberLyft are 1099S1099-K1099-NEC or you would. When you fill in your tax return online HMRC will automatically calculate how much tax you owe for you based.

High-income taxpayers-those with adjusted gross income of more than 150000. Yes most Uber drivers should be able to use the Section 199A deduction to deduct up to 20 of their business income. Add a slicer J Pr o tect sheets and ranges.

Ultimate Tax Guide For Uber Lyft Drivers Updated For 2022 That gets put in. Doing the math for a 40-hour work week thats 1214 a week and 63128 a year for picking up and dropping off passengers. You can find tax information on your Uber profilewell provide you with a monthly and annual Tax Summary.

If your annual income is over 37000 then the tax rate is 325 and you can get 675 1-325455625. Deduct your rideshare expenses. Once youve tried it out check out our list of 16 Uber driver tax write offs to see how you can save more on your year-end taxes thereby increasing your true profit.

Create a f ilter. With so many people looking to hail a ride the Big Apples Uber drivers have the potential to make up to 3035 an hour. Median Uber earnings per hour.

You do this by adding up all your sources of income and working out your tax rate based on the total.

Ultimate Tax Guide For Uber Lyft Drivers Updated For 2022

The Uber Lyft Driver S Guide To Taxes Bench Accounting

Ultimate Tax Guide For Uber Lyft Drivers Updated For 2022

Uber Drivers How To Calculate Your Taxes Using Turbotax Turbotax Uber Driver Tax Write Offs

How To Report Income From Uber In A Canadian Tax Return Youtube

Uber Tax Forms What You Need To File Shared Economy Tax

Uber Fare Estimate How Much Does Uber Cost How Much Will An Uber Cost This Is A Question Both Novice And Experienced Riders Ask On A Da Lyft Uber Unexpected

How To Read Uber Driver Tax Summary 2020 Explained Youtube

Instaccountant How To Read Uber Tax Summary 2019 Explained Facebook

Uber Eats Tax Calculator How Much Extra Will I Pay From Uber Eats Income

Uber Taxes Explained How To File Taxes For Uber Lyft Drivers Updated For 2020 Youtube

Uber Vat Compliance For French Partner Drivers

Uber Miles Lyft Driver Uber Driving Lyft

Uber Drivers And Canada Tax Deductions Cra Audit

Uber Tax Summary 2021 Compilation Spreadsheet For Uber Drivers Youtube

Taxes For The Gig Economy Uber Drivers And More Tax Economy Tax Help

Uber Reporting Income And Filing Taxes Senathi Associates

How To Unlock The Fm Radio Hidden On Your Smartphone Uber Smartphone Travel Tips

Uber Tax Calculator Calculate Your Uber Estimate Hurdlr Tax Uber Calculator